At the time of death of an individual, all his assets are considered to be deemed disposed and become part of his estate.

As estate is considered a Graduated Rate Estate for a period of 36 months after the date of death.

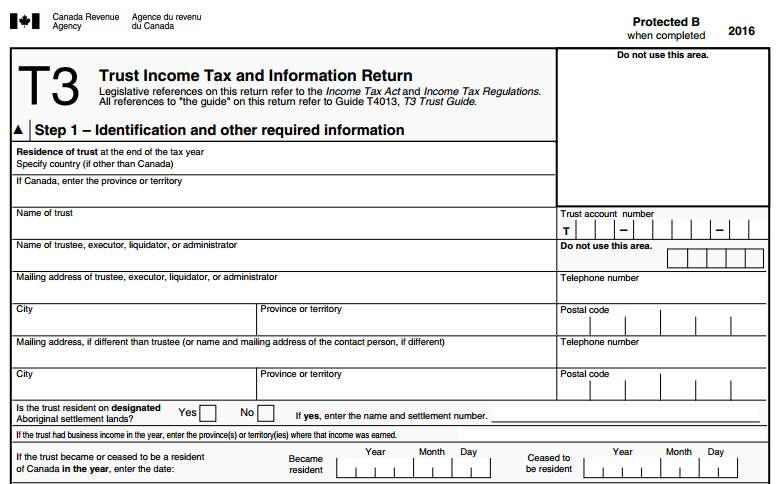

For the purposes of taxation, a T3 trust return needs to filed for all estates and trusts resident of Canada.

A trust is not a separate legal entity but is considered a separate entity for the purposes of taxation in Canada

Appletax specializes in estate tax planning and T3 Trust Tax Returns.

You can download T3 estate return package here.