It is now mandatory to report the sale of your house even if that house was your principal residence.

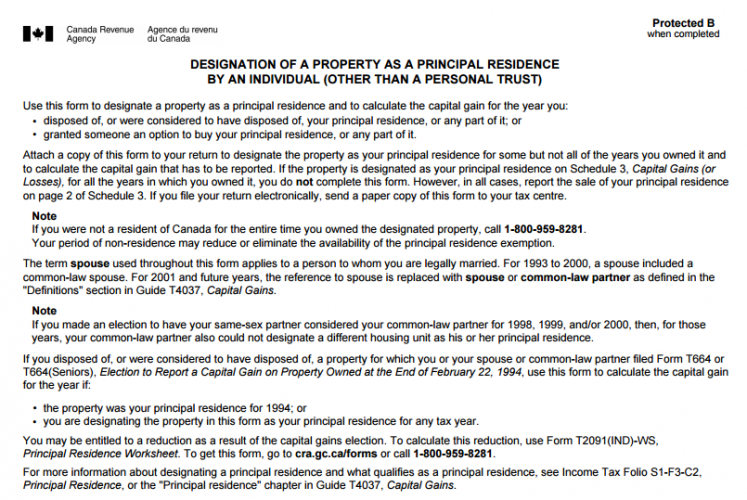

To avoid any capital gains tax, principal residence exemption can be claimed by filing the principal residence exemption form T2091.

The claim for principal residence exemption becomes complicated if the house was not your principal residence for all the years you owned it. It is highly recommended that filing of principal residence exemption should be handled by a tax professional.

To download T2091 form click here.