It is mandatory for every Canadian taxpayer to report any foreign property that you owned during the year valued over $100,000.

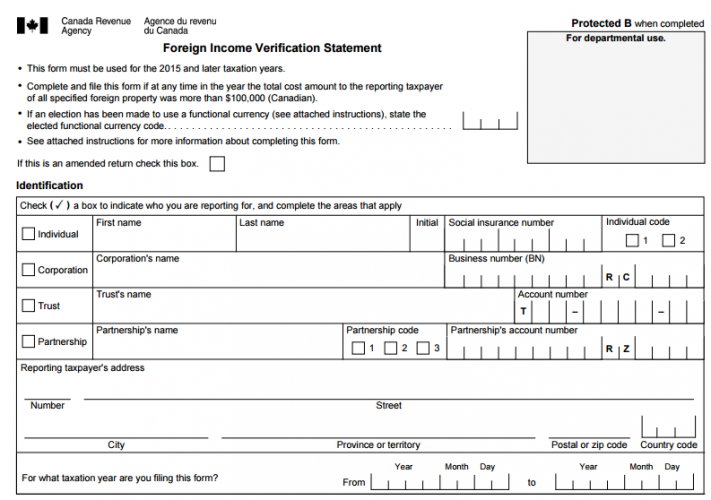

Foreign property can be reported by filing T1135- Foreign Income Verification Form.

T1135 – Foreign Income Verification Form needs to filed on annual basis for all the years a foreign property is owned.

Foreign property may include:

- Real Property

- Foreign private corporation ownership

- Foreign stocks

- Mutual funds

- Cash and Cash Equivalents in Foreign Banks

To Download The T1135- Foreign Income Verification Form Here.

Or

Visit a Appletax Office for assistance.