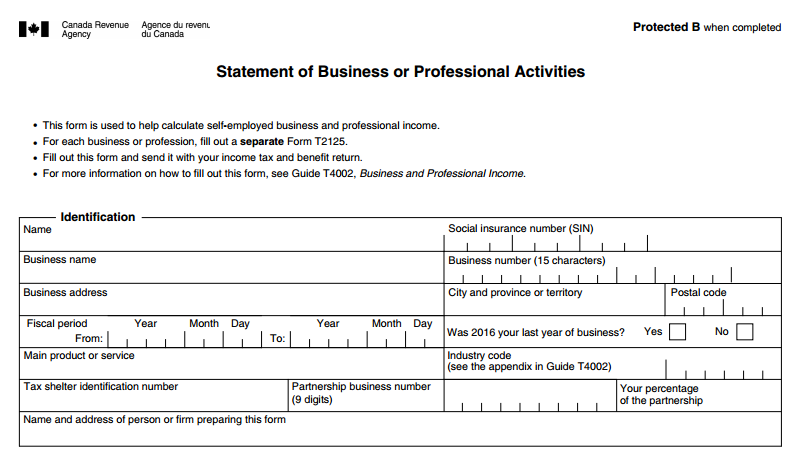

If you are self employed or run your own small business that is not incorporated, you are required to file T2125- Statement of Business Activities with your T1 tax return for reporting your business income.

You can claim expenses on your Gross Business Income business income and this will allow you to pay taxes only on income net of expenses

Small business and self employed people should collect GST and file a separate GST return.

You can claim all expenses relevant to your business. It is recommended to talk to accountant to ensure accurate claim of expenses on the business statement

To download T2125- Statement of Business Activities, click here.