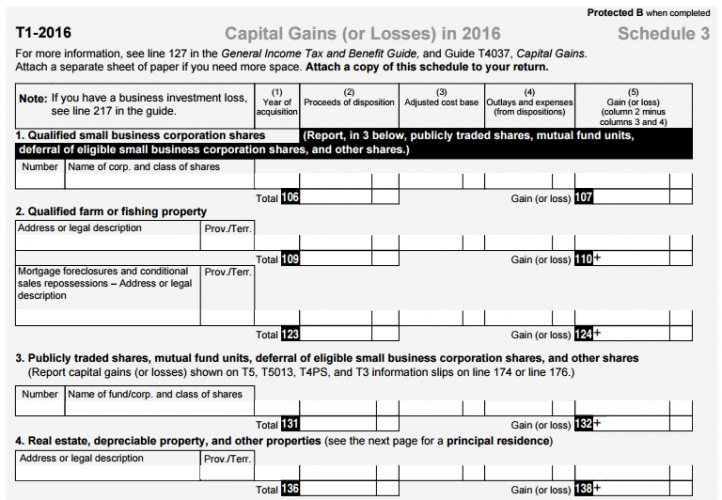

The schedule 3 form is used for reporting and Capital Gains or Losses on your capital property.

The capital property might include:

- Real Property

- Stocks

- Mutual Funds

- Small business corporation shares

- Farm or Fishing property

- Bonds, debentures and other debt instruments

- Personal Use property

- Listed personal property

You may be issued T3 , T5, T4PS, T5013 or T5008 information slips by your financial institution that will show your gains or losses.

The CRA records all your net losses and they will be reported on your Notice of Assessment.

Visit a Appletax Office to discuss all your Capital Gains Fillings.

To download Schedule 3, click here.