The T1 personal tax return is the tax return form required to be filed by all taxpayers in Canada.

This form is mostly filed electronically either by tax professionals using the E-File Service or by individuals using the Net File Service.

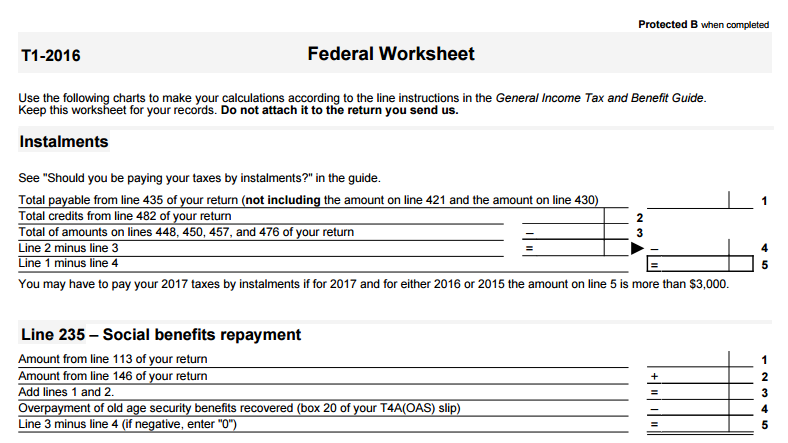

The T1 General Form lists all sources of your income, your refundable and non-refundable tax credits and calculates the taxes payable or refund for an individual.

You can download T1 general forms here.

learn more CRA Guideline about T1 Personal Tax

Employment expenses CRA guide Line 22900 Deduction for tools

you can visit for Tax deductions, credits, and expenses click here